The Bank Reconciliation enables transactions that have been posted to Tourplan G.L. bank accounts to be reconciled against physical bank statements.

The initialisation effectively allows the tagging of those historic transactions which are not going to appear on any future bank statement.

The Bank Reconciliation set up requires:

- Details of physical bank account(s) to be entered into Tourplan NX.

- Those physical bank accounts to be linked to Tourplan NX G.L. bank accounts.

- The starting bank statement page number and starting page balance to be entered.

These set up steps are entered in the Bank Reconciliation application.

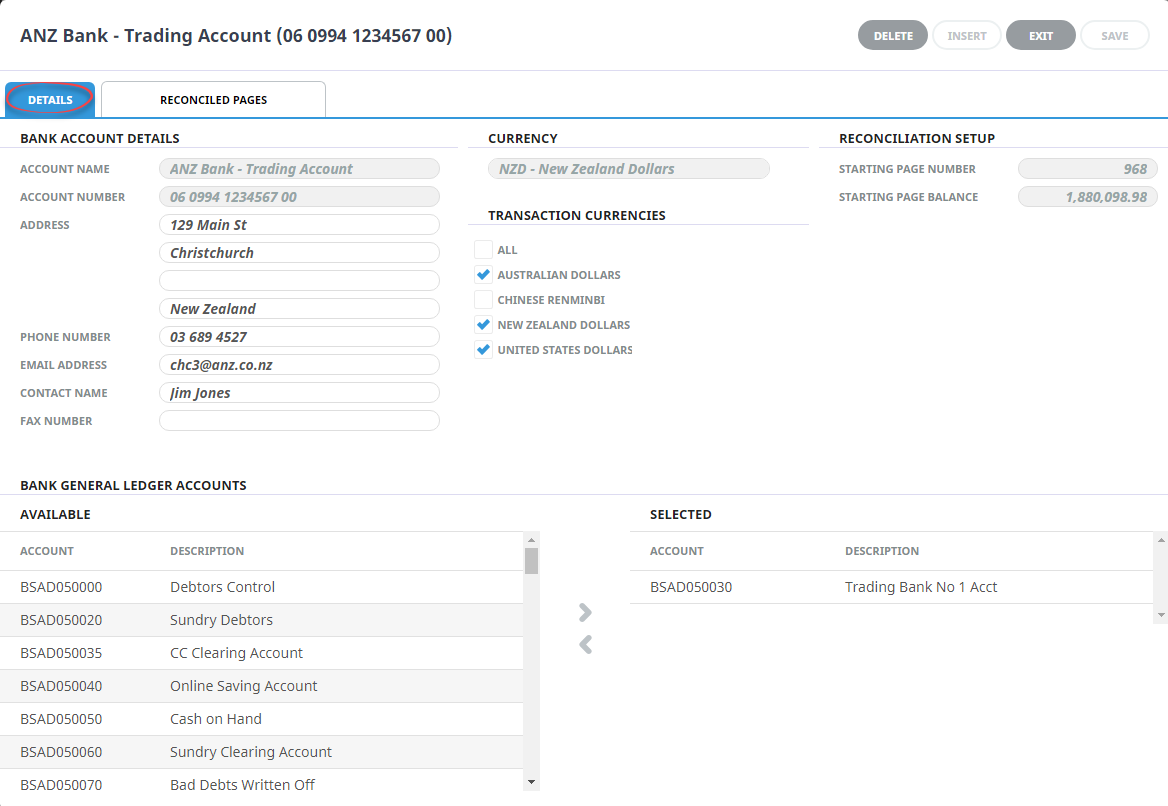

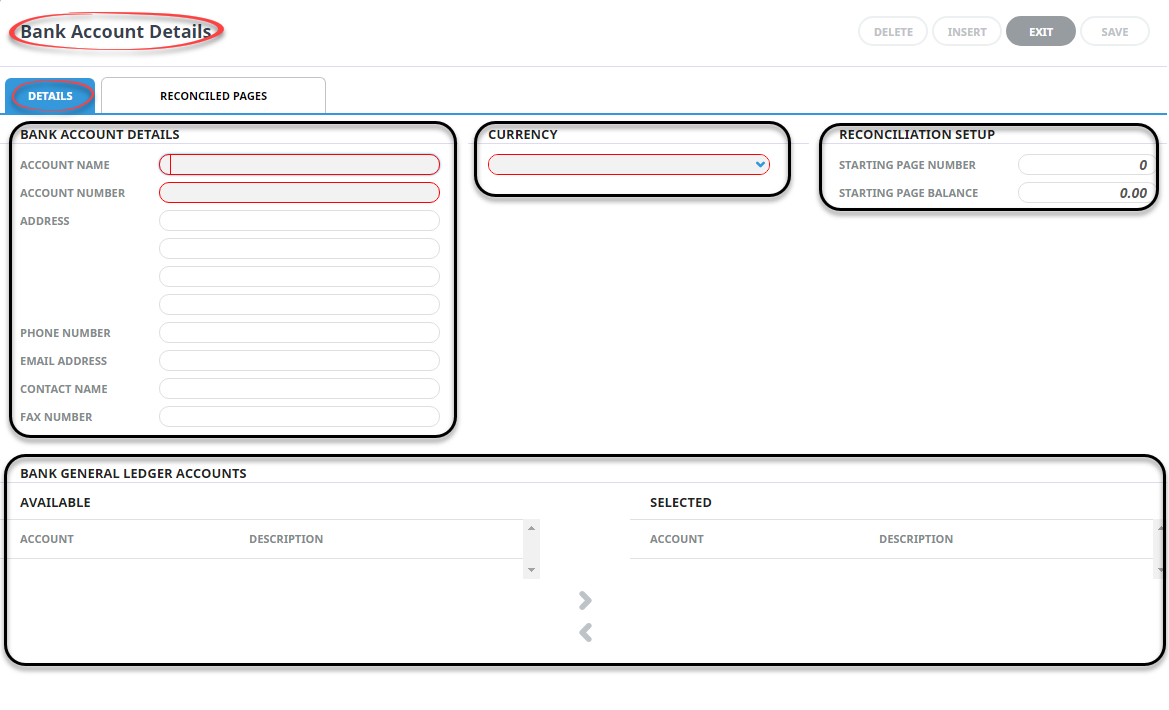

Example shows a Completed Bank Reconciliation - Bank Account Details Tab

Bank Reconciliation Setup

-

From the Home menu, select

Financials > Accounting > Bank Reconciliation.

Financials > Accounting > Bank Reconciliation.

-

The Bank Reconciliation screen will open. Click

Insert Account.

Insert Account.

-

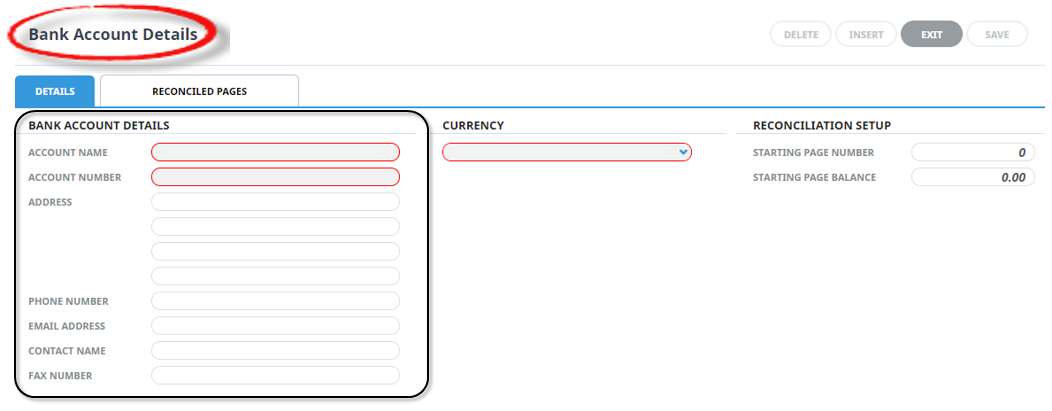

The Bank Account Details screen will display with the

Details tab open. Enter Bank Account Details including Account Name, Account Number and Contact Information.

Details tab open. Enter Bank Account Details including Account Name, Account Number and Contact Information.

-

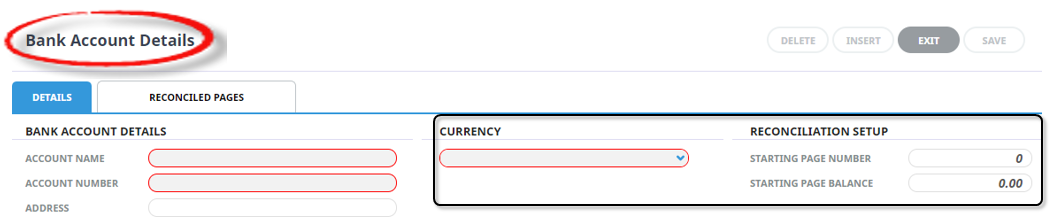

Select a

Currency and enter a Starting Page Number and Page Balance.

Currency and enter a Starting Page Number and Page Balance.

-

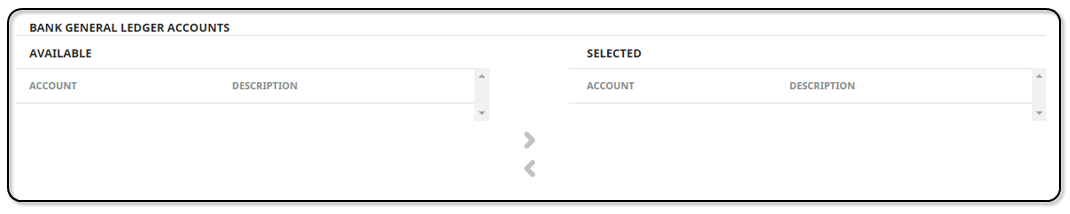

Attach a General Ledger account to the Bank Account by highlighting the Account in the

Available column and using the blue arrow

Available column and using the blue arrow  to move the Account to the Selected column.

to move the Account to the Selected column.

-

Click

Save to keep the changes.

Save to keep the changes.

-

Click

Exit to discard any changes.

Exit to discard any changes.

About the Bank Account Details Fields

When a new or additional physical bank account is created, information is displayed across two tabs; the Details tab and the Reconciled Pages tab. This screenshot

The Details Tab is in 4 distinct sections.

- Bank Account Details Section

- Currency Section

- Reconciliation Setup Section

- Bank General Ledger Accounts Section

About Details Tab

Bank Account Details Section

Account Name (Chr, 60 Required)

The bank account name as printed on the bank statement. This field can be used to select the bank account during the reconciliation or banking processes.

Account Number (Chr, 60 Required)

The number of the physical bank account. This field can be used to select the bank account during the reconciliation or banking processes.

Address and Contact Details

These fields are optional and are for information only.

Currency Section

Currency (Drop-down, Required)

Select the currency for this bank account.

Transaction Currencies (Multi Select List Box)

The transaction currencies that can be posted to this bank account.

Reconciliation Setup Section

Starting Page Number (Chr, 10)

NOTE: Enter the number prior to the number of the first bank statement to be reconciled. This will be used as the number of the initialisation .

The initialisation will hold all of the transactions which either make up or contribute to the opening balance of the first statement to be reconciled.

Starting Balance (Numeric 12,4)

Enter the amount that has been determined (in consultation with Tourplan Support) as being the balance that the Bank Reconciliation is going to commence with.

Bank General Ledger Accounts Section

This section is used to attach Tourplan NX G.L. accounts that have transactions that will appear on Bank Statements for the physical bank account.

To attach a G.L. account to the physical bank account, highlight the account in the Available column and click the  button. To remove a G.L. account from the Selected list, highlight the account and click the

button. To remove a G.L. account from the Selected list, highlight the account and click the  button.

button.